Reinventing the company as a digital bank and embracing a new purpose by creating a transformation ecosystem to support the business strategy and lay the foundations for future sustainability and growth.

In recent years, Payment Service Providers (PSPs) have significantly transformed the financial system, driving profound changes in the way transactions are made and payments are managed. These changes have benefited both consumers and businesses, revolutionizing how they interact with money. In this context, the transformation of traditional banks toward digital models accelerated to allow them to adapt to their clients’ new needs.

Banco del Sol, the digital bank of SANCOR SEGUROS, was digitally relaunched in August 2020 with the goal of reimagining the concept of banking, helping its clients evolve their relationship with their finances. The bank combines the best of both worlds: the strength, speed, and simplicity of cutting-edge technology and the warmth of human interaction to provide a complete and satisfying experience for both business and individual banking clients.

The transformation process began a year earlier when, with over 30 years of experience in traditional banking, Banco del Sol decided to reinvent itself as a digital bank, embracing the purpose of making its clients’ financial lives easier. This new beginning was driven by a startup mindset: innovation, agility, and passion as key drivers. A creative and risk-taking environment was fostered, with a focus on solving problems and creating value quickly and efficiently. This collaborative and dynamic culture, where every team member was committed to the company’s mission and growth, was the foundation of this new beginning, and we had the privilege to be a part of it.

The Challenge

As the industry was being reshaped by the emergence of new fintech companies, the 2020 pandemic created the perfect environment to launch a product like the one Banco del Sol was developing. The opportunity came at just the right time and demanded excellence. Speed began to play a crucial role in becoming part of this evolving market.

The success of the transformation required a focus on business processes, streamlining new client onboarding, and enabling the bank to adapt quickly to changes. This meant co-creating many of the processes from scratch and involving support areas such as Human Resources, Legal, Risk, and Compliance.

The Solution

Adopting a customer-centric mindset meant that all decisions, from product design to system implementation, were made with the goal of improving the customer experience. This focus permeated the entire organization by establishing agreements among key stakeholders to integrate all perspectives into truly effective solutions.

The organization adopted a product cell working model with teams made up of diverse profiles that complemented each other, collaborating to achieve a comprehensive vision and bring the business strategy to life. This agile approach facilitated quick adaptation to contextual needs and has since allowed the organization to respond to new changes and continuously implement improvements.

The Process area, led by Alejandro Gómez, played a key role in creating a transformation ecosystem that supported the business strategy and laid the foundation for long-term operational sustainability. From the beginning, we had the opportunity to be part of this team and embrace every challenge. Together, we thought, designed, documented, and executed. We combined traditional and agile methods, used process orchestration platforms like ARIS, and defined controls to ensure operational robustness.

Collaboration and leadership were essential to align all involved parties and ensure that the transformation initiatives were consistent and effective. The push for change generated transformative energy that spread throughout the organization. Teams felt motivated and committed to the objectives, making it easier to adopt new practices and overcome challenges. This collective enthusiasm was key to maintaining momentum and ensuring the success of the transformation.

This cultural shift not only transformed the way the organization operated but also strengthened its ability to adapt and thrive in a dynamic, customer-centric environment.

The Results

The transformation of Banco del Sol involved a significant cultural shift that gave its organizational structure the skills to capitalize on its experience within an agile framework. This approach created the space for the Process area to be present from the start in all the extended product cells, collaborating on the launch of numerous products and services, such as bill payments, peso savings accounts, and a newly redesigned debit card.

The extended cell configuration driven by the Process area helped establish the working model and support product cells and other areas in their continuous improvement processes. From Operations to Legal, Business, HR, and Back Office, the new culture spread, impacting management practices.

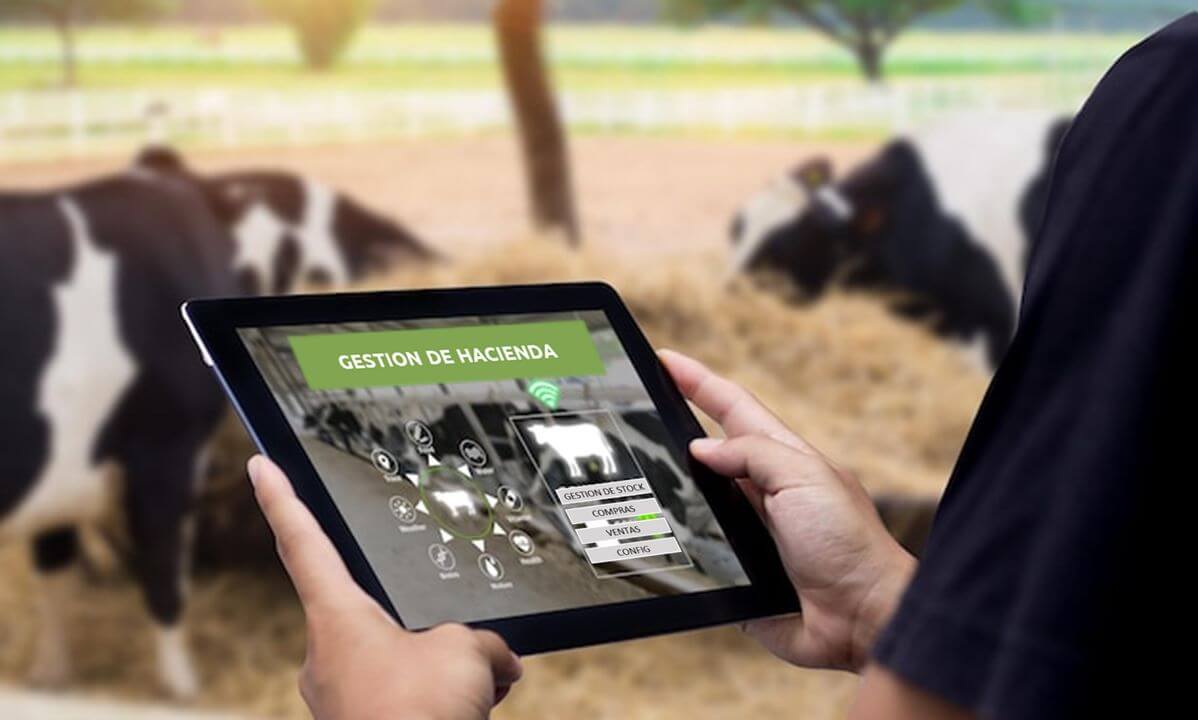

Banco del Sol positioned itself as an innovative entity in the Argentine financial market, with a strong focus on technology and accessibility. It reaches every corner of the country with its 100% free offering. With the goal of easily, quickly, and securely supporting its clients, it offers through the App a no-cost account with no opening or maintenance fees, personal, mortgage, and auto loans, a Mastercard credit card, a virtual debit card, and a Visa Contactless debit card. From its Business Banking services, it has introduced a digital web channel to allow clients to easily and quickly check balances, view transactions, access receipts, transfer to third parties, pay salaries, and operate with e-checks.

On the financing side, it supports agribusiness and SME sectors, focusing on the Sancor Seguros ecosystem, with digital offerings to leverage working capital, purchase supplies, climate insurance, and projects that involve the acquisition of capital goods.