A successful transformation strategy based on optimizing processes and technology, listening to customers, and empowering producers was the key to achieving a strategic position in the Argentine insurance market in just a few years.

SURA’s insurance subsidiary, Grupo de Inversiones Suramericana S.A. (Grupo Sura), was founded in Colombia in 1944 and is one of the largest Latin American companies in the insurance and financial services industry. With over 75 years of experience, SURA is currently present in nine countries and, according to the Fundación Mapfre ranking, is the fifth-largest Latin American insurance group operating in the region and the first among Spanish-speaking companies.

At the end of 2015, as part of its expansion efforts, SURA acquired RSA Seguros (Royal & Sun Alliance Seguros Argentina S.A.)’s Latin American operations. The company’s operational strength, professionalism, and the capabilities of its team, along with its substantial backing, were decisive factors in this acquisition. In 2016, the name change was formalized, and SURA officially entered the Argentine market.

The insurance industry was becoming increasingly competitive, with more companies entering the market. At the same time, customers became more aware of risk prevention, comparing values, prices, and coverage options.

In this context, SURA faced the challenge of establishing its brand in Argentina, developing strategic partnerships, and adapting to local market conditions. To achieve this goal, the company needed to focus on its ability to support clients by offering a differentiated portfolio of high-value solutions, along with comprehensive risk management services.

In 2017, in response to this new environment, Grupo Sura decided to modernize its technology platform to promote better operational practices and optimize processes aimed at improving customer service.

The challenge

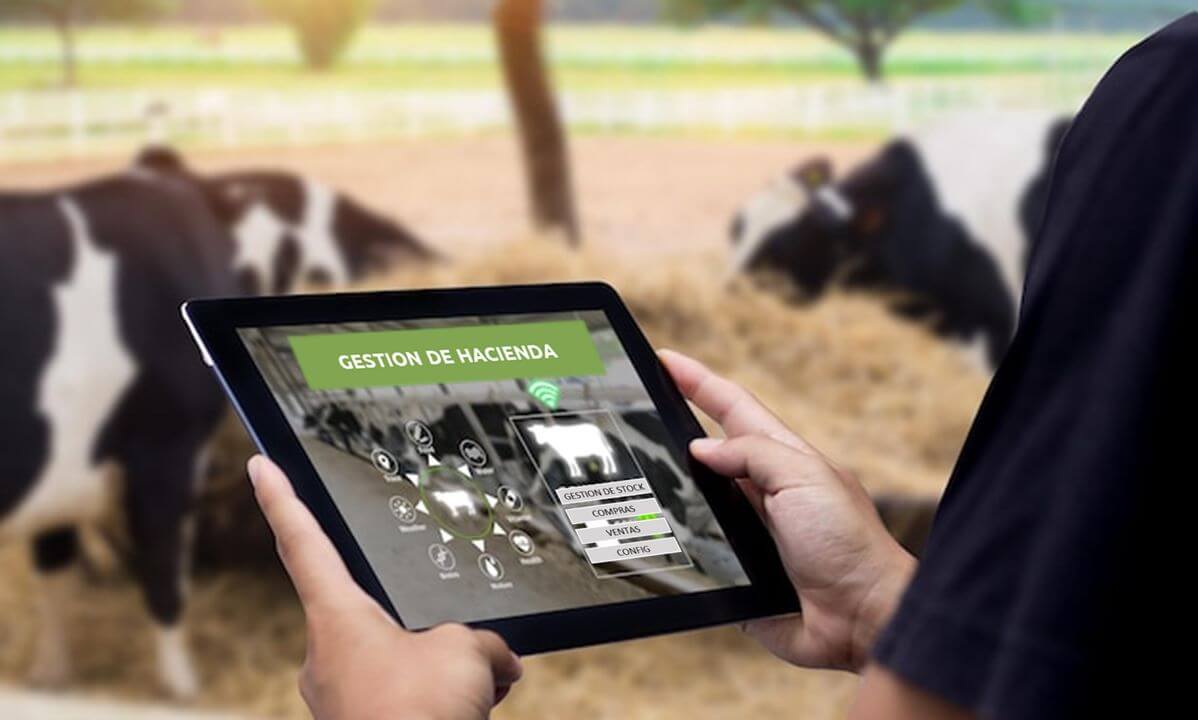

In addition to the cultural changes that come with entering new markets, Grupo Sura embarked on a re-engineering process of its core sales system, which involved the implementation, integration, and adoption of new tools. Policy issuance and billing, as well as claims management, were handled across six different systems, making it essential to unify them into a single platform. Simultaneously, the company faced the challenge of encouraging self-management among insurance producers and improving integrations with other channels (producers, direct sales, etc.), which often translated into web services.

Meanwhile, market demands highlighted the need to address the growth and transformation of various sales channels, both direct and indirect. This challenge fostered the development of strategic partnerships to enhance the company’s positioning in Argentina while promoting its differentiated value proposition, as well as efficiency, quality, and responsiveness to the voice of the customer.

The solution

SURA’s leadership understood that evolving to navigate these changes required strategic conviction and operational soundness. Two key initiatives were launched. Through the Silver Arrow program, the company led the transformation of its core sales system and processes, alongside the implementation of Guidewire as the sole management platform. At Axonier, we supported the transformation by designing new end-to-end sales processes and managing change for all employees in Argentina, raising awareness, preparedness, and engagement.

Additionally, the Andes Project focused on transforming the company’s Administration, Finance, and Procurement processes by implementing SAP to support operations and evolve management practices. For a company of SURA’s magnitude, effective handling of these processes is critical, as they involve a high volume of daily transactions, multiple payment instruments, and various scenarios. During this phase, the Axonier team integrated into the project, designing new procurement and payment processes, as well as analyzing, defining, and testing the implemented functionalities and providing post-implementation support.

Once the supporting systems ensured data integrity and consistency, the Commercial Directorate tackled the market challenges by offering a new value proposition. This involved transforming the global sales cycle and that of each insurance producer to optimize and standardize processes. Producers became key players, serving as the bridge between the company and its end customers, not only for promotion and customer acquisition but also for long-term service and loyalty building.

Together with the SURA team, we designed a series of collaborative workshops, both in-person and virtual, based on Lean, Agile, and Design Thinking principles. We worked with producers to adopt a mindset and a set of tools for process management that allowed them to identify deviations and implement continuous improvement actions. In a flexible and agile environment, high-value opportunities were identified and transformed into quick wins, with results visible in the short term.

The result

In a challenging environment for all sectors of the Latin American economy, SURA has demonstrated its commitment to the well-being of individuals and achieved a high level of competitiveness within the region’s companies. It has secured a remarkable position in the national insurance market, reporting historic growth in its business.

Over the years, through the Silver Arrow and Andes projects, more than 140 processes have been defined and implemented, transforming the business, enhancing the value proposition, and empowering both insured clients and producers.

The immersive experience aimed at fostering a continuous improvement mindset reached a total of 50 insurance producers, transforming end-to-end processes and delivering concrete results. These outcomes, supported by feedback, multiplied successes. Over 420 internal improvement initiatives were identified, estimated, evaluated, and prioritized for implementation.

The results of this collaboration speak for themselves. The voice of those involved is fundamental. Most participants rated SURA’s Lean initiative as excellent, with over 80% finding the workshops highly useful and appreciating the chosen dynamic. “I was very satisfied with the experience… The methodology seemed very interesting and helpful,” said a customer service producer upon completing the program. The consolidated results and experiences from these five years of joint work ensure that Grupo Sura continues to choose us as their partner to shape new business challenges in an ever-changing, highly competitive insurance environment.